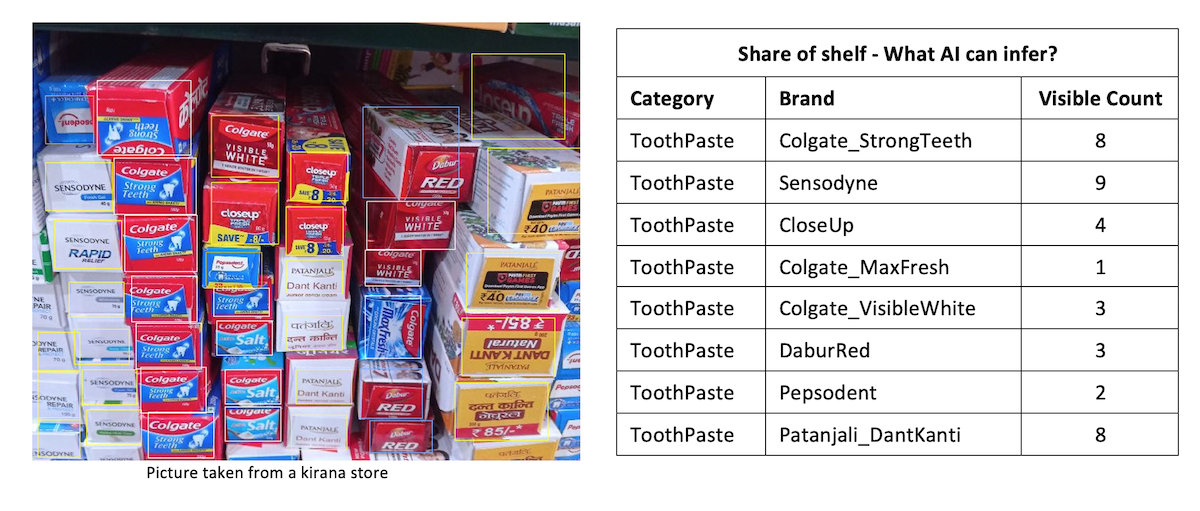

The need for touch and feel is the key driver that drives the traffic to brick and mortar stores worldwide. The immersive experience and the recognition the shoppers get, drives them to search online and buy offline. The major challenge for brands is the distribution of products and securing shelf space inside the store. This calls out for measuring techniques that can gauge the shelf and provide data about own brand as well as the competition in real-time.

Measuring on-shelf presence of a brand is labor intensive activity. The shelf audit generally has the following activities:

- Identifying the presence or absence of the brand

- Visible count of our own brand and the competition

- Presence of different SKU’s

- How does the count of brands / SKU’s vary across different outlet types – Kirana vs Modern Retail?

- Presence of relevant competition – in the shelf / in the outlet.

How does this help you?

Answers to the above, goes beyond answering the questions of brand visibility. Some of the imminent advantages:

1. Track how hard your brand is working on the shelf:

- The share of shelf analysis allows you to pinpoint products that are less-spaced or over-spaced and therefore become value drainers or drivers of your brand.

- Brands and products that are over-performing in a particular type of outlet might be able to deliver increased sales if allocated more space in the shelf. The reverse is also true. Under performing products occupying bigger shelf space can drain the opportunities in favor of competition.

- By looking at the trends of share of shelf over a period of time, brands can uncover valuable insights that becomes the driver factors for the category and the brand growth.

2. New product launches often requires a larger shelf space for higher visibility.

- Image analysis allows quicker identification of availability of the product immediately after launch.

3. Negotiations with retailer:

- Identify competition brands that occupies larger shelf space leading to under-performance of the brand.

The granular store level details allow you to engage in meaningful conversations at a strategic level with your retail partners. Whether you are a category champion or a challenger brand, combining shelf data with sales and inventory data provides actionable answers to burning questions:

- Why are shelf-gaps arising?

- How frequently does it happen?

- Is there a pattern in the type of outlets that deviate?

- What is the cost-benefit of optimising space?